You are here

Saudi Arabia's economic shake-up signals planning for cheap oil

By Agencies - Dec 29,2015 - Last updated at Dec 29,2015

In this September 17 file photo, the tallest clock tower in the world with the world's largest clock face, atop the Abraj Al Bait Towers, overshadows mountain slums in the holy city of Mecca (AP photo)

DUBAI — Saudi Arabia's planned cuts in spending and energy subsidies signal that the world's largest crude exporter is bracing for a prolonged period of low oil prices.

The heavyweight member in the Organisation of Petroleum Exporting Countries (OPEC) shows no signs of wavering in the long-term oil strategy it has orchestrated since last year. Instead, it appears willing to continue tolerating cheap crude to defend market share and wait for the market to balance without cutting supplies, oil sources and analysts say.

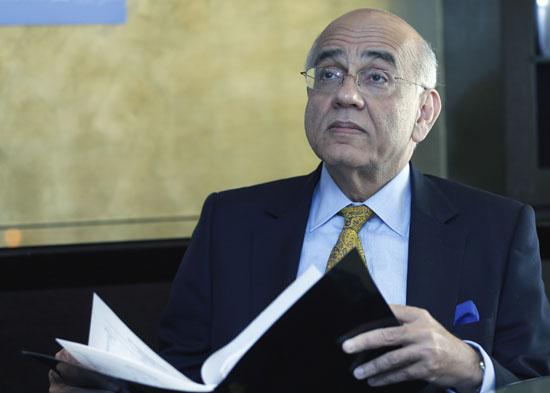

In one of the strongest signals that the kingdom will stay the course despite the impact on its finances, Saudi Aramco's Chairman Khalid Al Falih said it could outlast others.

"We see the market balancing sometime in 2016, we see demand ultimately exceeding supply and soaking up a lot of the excess inventory and prices in due course will respond regardless of when and by how much," Falih told a news conference late on Monday detailing next year's budget.

"Saudi Arabia more than anyone else has the capacity to wait out the market until this balancing takes place," he said.

According to analysts, the plans announced on Monday to shrink a record state budget deficit with spending cuts, reforms to energy subsidies and a drive to raise revenues from taxes and privatisation showed Riyadh was expecting lower revenues.

"We don't see any changes to Saudi Arabia's oil policy — in the context of oil production," said Amrita Sen, chief oil analyst at consultancy Energy Aspects.

"The budget changes suggest they are expecting oil prices to stay low for some time and the reforms are a small step towards addressing that," he added.

Belt-tightening

The 2016 budget and reforms announcements marked the biggest shake-up to economic policy in the kingdom for over a decade and aimed to cut the government deficit to 326 billion riyals, down from 367 billion riyals or 15 per cent of gross domestic product (GDP) in 2015.

Next year's budget projects spending of 840 billion riyals, down from 975 billion riyals spent in 2015.

The government also said it was hiking prices for fuels, water and electricity as well as gas feedstock used by industry, as part of politically sensitive subsidy reforms.

"Saudi Arabia can either spend its way out of the current scenario or start belt-tightening. In the past, the country has spent lavishly on health, education and infrastructure in difficult times knowing that oil prices will be supportive," said Asim Bakhtiar, head of research and investment advisory at Saudi Fransi Capital.

"If oil has entered a down cycle then belt-tightening will prevail," he added.

Falih, who is also the health minister, became chairman of Aramco, the world's biggest state energy firm, earlier this year after more than 30 years in the company.

As one of a handful of Saudi figures whose views are closely watched by traders and analysts for any insight into the kingdom's oil thinking, Falih has long been considered a possible successor to Saudi oil minister, Ali Al Naimi.

His appearance at the news conference with two other ministers, during which he shared his views on oil prices and market assessment, was seen as a possible signal he could be named oil minister when Naimi, 80, eventually retires.

OPEC rolled over its year-long strategy of pumping at will at its December 4 meeting, raising the stakes in its survival-of-the-fittest market strategy.

Riyadh was the driving force behind OPEC's shift in policy last year, rejecting calls to reduce output to support oil prices that are trading this month at their lowest since 2004. It chose instead to defend market share against higher-cost-rivals.

Falih noted that the policy had borne fruit.

"Over the last year we have seen the down cycle in the oil markets have a significant impact on both supply and demand. Supply has plateaued in North America and started declining by significant amounts, and we expect that to continue or perhaps accelerate in 2016," he said.

Brent was trading at around $36.85 a barrel on Tuesday, a sharp drop from a high of $115 a barrel in June 2014 before OPEC's policy shift.

The finance ministry did not disclose the average oil price assumed in its 2016 budget calculations but economists estimated it was about $40 a barrel and saw crude production remaining high at above 10 million barrels per day next year.

"We do not see Saudi Arabia cutting production in order to support upward movement in prices. So far, Saudi policy of gaining market share has worked, with lower prices undercutting both OPEC and non — OPEC competitors in key markets," wrote analysts at Jadwa Investment, a leading Saudi financial firm, in a note on Tuesday.

Long accustomed to cheap utilities and some of the lowest petrol prices in the world, Saudis woke to a shock Tuesday as authorities made massive subsidy cuts after falling oil prices caused a record deficit.

In a clear departure from its decades-old generous welfare system, Riyadh announced prices would rise on fuel, electricity, water and even plane tickets and cigarettes.

Residents of the oil-rich Gulf kingdom have long enjoyed cheap prices on basic goods and services, but officials made clear that was no longer sustainable after the stunning drop in crude prices over the last 18 months.

"We have to rationalise unnecessary spending. This requires changes to focus on essential expenditures," Finance Minister Ibrahim Al Assaf was quoted as saying Tuesday by the Al Eqtisadiah newspaper.

After years of high spending, authorities moved swiftly to impose unprecedented cuts after announcing Monday a 2015 budget deficit of $98 billion, the largest in Saudi history and a whopping 15 per cent of GDP.

Prices on fuel products were raised by up to 80 per cent as of midnight, including a 50 per cent jump in the price of the most commonly sold petrol to 0.90 riyals ($0.24) per litre.

Vehicles thronged petrol stations in Saudi Arabia Monday evening to fill up tanks at the old rates.

Abu Othman, a 63-year-old motorist, noted that despite the increase, petrol prices remained "reasonable".

"It is natural to expect such measures in these circumstances," he said while filling his car.

'Wrong economic policies'

The swift action to cut subsidies was unexpected, even if there had been no doubt Saudi Arabia would post a deficit this year.

With oil prices expected to remain low, Saudi authorities also projected a shortfall of $87 billion in the 2016 budget.

Revenues in 2015 dropped to $162 billion, the lowest since the global financial crisis in 2009, due to a massive $123 billion fall in oil revenues.

The contribution of oil income to revenues dropped to just 73 per cent in 2015, from an average of 90 per cent in the past decade.

The budget and price increases dominated talk on Saudi social media on Tuesday, with Twitter user Fahad Al Owain saying many would suffer from the price hikes.

"Rich people can overcome the rises but the poor depend on the government," he wrote.

Another Twitter user, writing under a pseudonym, blamed "wrong economic policies for the record budget deficit".

But others said it was time for Saudis to tighten their belts.

"I believe this budget will teach us the art of rationalising consumption," Twitter user Udai Al Dhaheri wrote.

Authorities announced other measures aimed at reducing Saudi Arabia's reliance on oil revenues by diversifying the economy, including by increasing charges on public services.

Non-oil revenues rose by 29 per cent this year to $43.5 billion, contributing 27 per cent to public revenues.

But Saudi economist Abdul Wahab Abi Dahesh said much more needed to be done.

"This remains a very small contribution and needs to be increased," he said. "I expect that the government will be able to easily raise non-oil revenues above the 200 billion riyal [$53 billion] mark next year with the introduction of the new fees."

That would boost non-oil income to around 40 per cent of public revenues, a new landmark for the kingdom.

In a speech to cabinet on Monday, King Salman, overseeing his first budget since taking over the country in January, emphasised the need for diversification.

"This budget represents the beginning of a comprehensive programme to build a strong economy... with various sources of income," he said.

The International Monetary Fund has warned Riyadh that failure to cut spending and implement reforms will eat up the country's fiscal reserves in just five years.

The kingdom withdrew more than $80 billion this year from the reserves, which stood at $732 billion at the end of 2014, and issued bonds worth around $20 billion.

Related Articles

Saudi Arabia announced a 2015 budget with a huge deficit at the weekend as the world's largest crude exporter begins to feel the impact of its own decision not to shore up oil prices.

Gulf oil exporters must reduce spending, including subsidies and diversify their economies to cope with lower revenues caused by the sharp drop in crude prices, the International Monetary Fund (IMF) said.

Plunging oil prices could mean the first budget cuts for major exporter Saudi Arabia since 2002 but they are not expected to be large enough to stop growth in the Arab world's biggest economy.