You are here

Automakers say electrics, hybrids no longer just gas-sippers

By AP - Mar 23,2016 - Last updated at Mar 23,2016

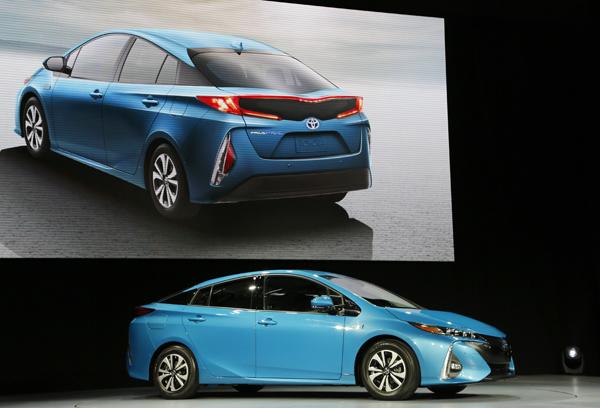

The 2017 Toyota Prius Prime is shown at the New York International Auto Show, in New York, on Wednesday (AP photo)

NEW YORK — When Toyota aired a Super Bowl television ad featuring a surprisingly quick Prius gas-electric hybrid eluding police, it marked a turning point for the auto industry.

For years, automakers pushed fuel efficiency to sell hybrid and electric vehicles. Now, in an era of cheap gasoline, the message is: These cars are faster and quieter than their gas-powered counterparts. And, yes, you still save on fuel.

“They’ve graduated out of the class of something that’s a bit of an oddity to drive,” says Mike O’Brien, vice president of product planning for Hyundai. “It’s all about making these cars better.”

Until now, hybrids and electrics have largely appealed to the environmentally-conscious crowd. The vehicles cost thousands of dollars extra, and although drivers eventually recouped their money in fuel savings, the vehicles lacked the power and handling of gas-powered rivals. Electrics also suffered from driver concern that the battery could run out of juice on a trip.

Now, the tide is slowly turning. General Motors and Tesla will bring electric vehicles to market next year priced around $30,000, including a $7,500 federal tax credit. Battery range has improved significantly, experts expect gasoline prices to eventually climb higher, and the advent of autonomous vehicles favors motors powered by electricity over gas.

At the New York International Auto Show on Wednesday, Hyundai and Toyota showed off new electric and hybrid vehicles. Hyundai unveiled battery, gas-electric hybrid and plug-in versions of a new car called the Ioniq, while Toyota showed the plug-in Prius Prime, which can go 35.5km on electricity before the gas-electric power system kicks in. The electric range is double the old version.

The Prius hybrid, powered by gas and electric motors, started the alternative fuel movement in the US in 2000. Toyota deliberately made it look different than other cars, knowing that buyers wanted to make a statement about being environmentally friendly. Other companies set their green cars apart as well.

Even though sales grew as manufacturers added models, they never really caught on, partly because of the improved fuel economy of gas-powered vehicles. At their peak in 2013, with gas averaging $3.50 per gallon, Americans bought only 341,000 hybrids and electrics, about 2.2 per cent of total US car sales, according to Kelley Blue Book.

Companies spent millions developing the cars, taking losses to meet government fuel economy standards that gradually increase and require the new-car fleet to average 87.7km per gallon by 2025.

As gas prices fell below $2 per gallon, sales of hybrids and electrics dropped further. Last year, automakers had 16 hybrid and electric models on sale, but sales sank to just over 274,000.

All of this makes for a bad environment to roll out more hybrids and electrics. But automakers will press on, now selling them on style, acceleration, handling and reliability.

Electric vehicles have few moving parts. “They require far less service,” Renault-Nissan CEO Carlos Ghosn said Wednesday. “No oil changes, and they are extremely reliable.”

As a power source, electricity outpaces gasoline in just about every area, says Karl Brauer, senior auto analyst for Kelley Blue Book. Advancements have made batteries smaller, increased their storage capacity and brought prices down. Electric motors can take off faster than gas engines, and hybrids can power wheels with both electric and gas motors for better acceleration. Electrics also are far quieter.

Yet at $2 per gallon, it would take more than 10 years to recoup the $3,720 price difference between a base model Toyota Camry hybrid and its four-cylinder gas-engine counterpart. But that’s not always a fair comparison, said Stephanie Brinley, senior analyst for IHS Automotive. Hybrids often come with more equipment and are comparable to better-equipped, pricier models, she said.

The coming debuts of the Chevrolet Bolt and Tesla Model 3, which will have 322km of electric range, should make battery electric vehicles more appealing, even with cheap gas, Brauer said. A lack of charging stations, once thought to limit adoption of electrics, becomes almost moot because of the longer range, he said.

Self-driving cars, which would use electric motors that can be recharged without humans, also would boost sales.

Brauer thinks electrics and hybrids will make up more than half of US sales in the next 12 years as SUVs and trucks get the new systems. Hyundai’s O’Brien thinks the shift will happen sooner.

Any spike in gas prices will only help. The International Energy Agency last month predicted that oil prices will more than double by 2020 because drillers are cutting investments due to current low prices, which will eventually reduce supply.

But even with cheap oil, Mick Roberts, a 46-year-old hydrogen engineer from Lowell, Indiana, bought a 2015 Chevrolet Volt hybrid in October when gas was $2.20. He got a good deal on an outgoing model, but Roberts says he likes the smooth-shifting, quiet motor and quick acceleration. “It would be tough to go back to gas,” he said.

Still, the automakers know it will take a lot of marketing to get mass adoption.

Bill Fay, Toyota’s US general manager, says there will be more chapters in the Prius police chase ad series, including one for the new plug-in. “The early adopters understand the differences in the technology,” he said. “But with the mainstream customers, we all still have a ways to go to explain the benefits.”

Related Articles

NEW YORK — Instead of dishing out a hybrid, plug-in hybrid or a electric vehicle, Hyundai did all three — in a single car.It’s the new

In 1997, Toyota caught its competitors by surprise with the revolutionary Prius, the first commercially successful gasoline-electric hybrid car. Now, the Japanese firm is trying to do the same with a technology that seems straight out of science fiction.

NEW YORK — The world's top automakers — motivated either by governmental regulations or pure profit — have made a sharp turn away from fossi